Mobile phones have made life easier in India. We use them for calls, banking, shopping, learning, and even running businesses. But as smartphone usage has increased, mobile phone scams have also grown rapidly.

Scammers and fraudsters no longer rely on just fake calls. They use SMS, WhatsApp, email, apps, and even social engineering tricks to cheat people. Anyone can become a target—students, working professionals, senior citizens, Android users, and even iPhone users.

“Fraud does not depend on how smart you are. It depends on how alert you stay.”

This article explains the 10 most common mobile phone scams in India, how they work, and clear steps to avoid them. The goal is simple: help you protect your phone, your data, and your money.

Why Mobile Phone Scams Are Increasing in India

Mobile scams are rising because:

- Digital payments and UPI usage are growing

- Many users are new to online banking

- Scammers use fear, urgency, and trust to manipulate victims

- Personal data leaks make targeting easier

A mobile phone is now a wallet, ID, and communication device combined. That makes it a valuable target. Along with using mobile phones safely, it’s also important to follow proper manners and etiquette of cell phones while using them.

1. Fake Customer Care Call Scam

This is one of the most common phone scams in India.

How the scam works

- You search online for customer care of a bank, telecom, or app

- A fake number appears at the top

- The scammer pretends to be support staff

- They ask for OTP, card details, or remote access

Why people fall for it

- The caller sounds professional

- The problem seems real

- Victims want quick solutions

How to avoid it

- Never trust numbers from random websites

- Use official apps or verified websites only

- No real customer care asks for OTP or PIN

2. OTP Scam (One-Time Password Fraud)

OTP scams target both Android phones and iPhones.

How it happens

- You receive a call saying “Your account will be blocked”

- The caller asks you to share an OTP “for verification”

- Once shared, money is transferred instantly

Important fact

- OTP means approval, not verification

How to stay safe

- Never share OTP with anyone

- Banks, apps, and payment services never ask for it

- Disconnect the call immediately

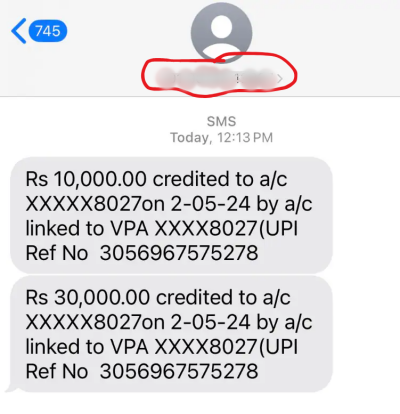

3. UPI Collect Request Scam

This scam affects mobile payment users heavily.

How it works

- Scammer sends a UPI “request”

- Says it is a refund, cashback, or prize

- Victim approves the request thinking money will come in

Reality

- Approving a request means you are paying, not receiving

Safety tips

- Money is received automatically in UPI

- Never approve unknown collect requests

- Double-check the payment screen

4. Fake Courier or Delivery Scam

This scam targets online shoppers.

How it works

- You get a call or SMS about a parcel

- They say delivery is stuck due to address or customs

- You are asked to pay a small fee or share details

Why it works

- Many people order online regularly

- The message sounds routine

How to avoid it

- Check directly on the official courier website

- Do not click links from unknown SMS

- Do not pay unless you confirm the order

5. SIM Card Block or KYC Scam

This scam creates fear and urgency.

What scammers say

- “Your SIM will be blocked today”

- “KYC not completed”

- “Press 1 to talk to an executive”

What happens next

- Call is transferred to a scammer

- They ask for personal details or OTP

How to stay protected

- Telecom companies do not block SIMs via calls

- Ignore automated threats

- Contact your operator through official apps

6. WhatsApp and Social Media Scams

Messaging apps are now major scam platforms.

Common types

- Fake prize or lottery messages

- “Is this you in the video?” links

- Account takeover links

- Fake job offers

Risk

- Clicking links can steal data

- Accounts may get hijacked

Safety tips

- Do not click suspicious links

- Enable two-step verification

- Verify messages with the sender directly

7. Loan App and Instant Credit Scam

This scam targets people looking for quick money.

How it works

- Fake loan apps offer instant approval

- Ask for contacts, media, permissions

- Later threaten or blackmail users

Warning signs

- No proper website

- No customer support

- Requests full phone access

How to avoid it

- Use only trusted loan apps

- Check app reviews carefully

- Avoid apps asking unnecessary permissions

8. Fake Job Offer Scam

This scam is common among students and job seekers.

How it works

- You get a call or message for a job

- Asked to pay registration or training fees

- After payment, communication stops

Red flags

- Job without interview

- Payment asked before joining

- Generic email IDs

How to stay safe

- No genuine job asks for money

- Research the company

- Avoid urgency-based offers

9. Screen Sharing or Remote Access Scam

This scam targets smartphone users directly.

How it happens

- Scammer asks you to install a “support app”

- App gives them screen access

- They watch OTPs and banking actions

Why it is dangerous

- Complete control over your device

- Banking apps can be compromised

Protection tips

- Never install remote access apps on request

- Delete suspicious apps immediately

- Reset phone if needed

10. Fake Prize, Lottery, or Reward Scam

This scam uses excitement as a weapon.

Common messages

- “You won a lucky draw”

- “Your number selected”

- “Claim reward now”

Reality

- You are asked to pay tax or fees

- Money is lost permanently

How to avoid it

- You don’t win contests you never joined

- Ignore such calls and messages

- Block and report the number

Common Signs of a Mobile Phone Scam

Watch out if:

- Caller creates fear or urgency

- You are asked to act immediately

- You are asked for OTP, PIN, or password

- Offers sound too good to be true

These are classic scam patterns.

What To Do If You Are Scammed

If fraud happens:

- Block your bank card or account immediately

- Inform your bank or payment app

- Report to cyber crime helpline

- Preserve call logs and messages

Quick action can sometimes reduce losses.

Learn what the Freedom 251 scam was and how it misled millions of buyers in India.

How Government and Banks Warn Users

Authorities like Reserve Bank of India and Telecom Regulatory Authority of India regularly issue safety advisories. Banks also send alerts warning users not to share OTPs or credentials.

Following these basic rules protects most users.

Myths About Mobile Phone Scams

- ❌ Only uneducated people get scammed

- ❌ iPhone users are always safe

- ❌ One antivirus app can stop all fraud

Scams depend on psychology, not intelligence or phone brand.

Simple Daily Habits That Keep You Safe

- Do not answer unknown calls carelessly

- Read SMS and app messages fully

- Keep phone and apps updated

- Educate family members, especially elders

“Awareness is the strongest antivirus!”

Options for Complaint to Authorities After You Are Scammed

- Contact your bank or payment provider immediately to block further loss and raise a complaint (UPI app, bank helpline, or card issuer).

- Gather all evidence such as bills, screenshots of payments, SMS, WhatsApp chats, emails, and call logs.

- Call the National Cyber Crime Helpline: Dial 1930 (available 24×7 across India).

- Report online on the Cyber Crime Portal: https://cybercrime.gov.in

- Visit your local police station or Cyber Crime Cell and submit a written complaint with proof.

- Report fraud calls, SMS, or WhatsApp scams on Sanchar Saathi (Chakshu): https://sancharsaathi.gov.in

Act quickly: Reporting within the first few hours greatly improves recovery chances.

Frequently Asked Questions (FAQs)

1. Can I get my money back after being scammed?

In some cases, yes. If you report the fraud quickly to your bank, payment app, and the cybercrime helpline (1930), there is a higher chance of freezing or recovering the amount.

2. How soon should I report a scam?

You should report it immediately, preferably within the first few hours. Delays reduce the chances of recovery and action.

3. What proof is required to file a complaint?

Payment receipts, screenshots, SMS or WhatsApp chats, call details, bills, and any communication with the scammer are usually sufficient.

4. Should I visit the police station if I have reported online?

Yes. For serious cases or large amounts, visiting the local police station or cyber crime cell helps in faster investigation and follow-up.

Final Thoughts: Stay Alert, Stay Safe

Mobile phone scams are a reality of the digital age. But most scams fail when users pause, think, and verify.

You do not need technical knowledge. You only need awareness and patience. A few extra seconds of caution can save years of regret.

Stay informed. Share this knowledge. Help others stay safe too.